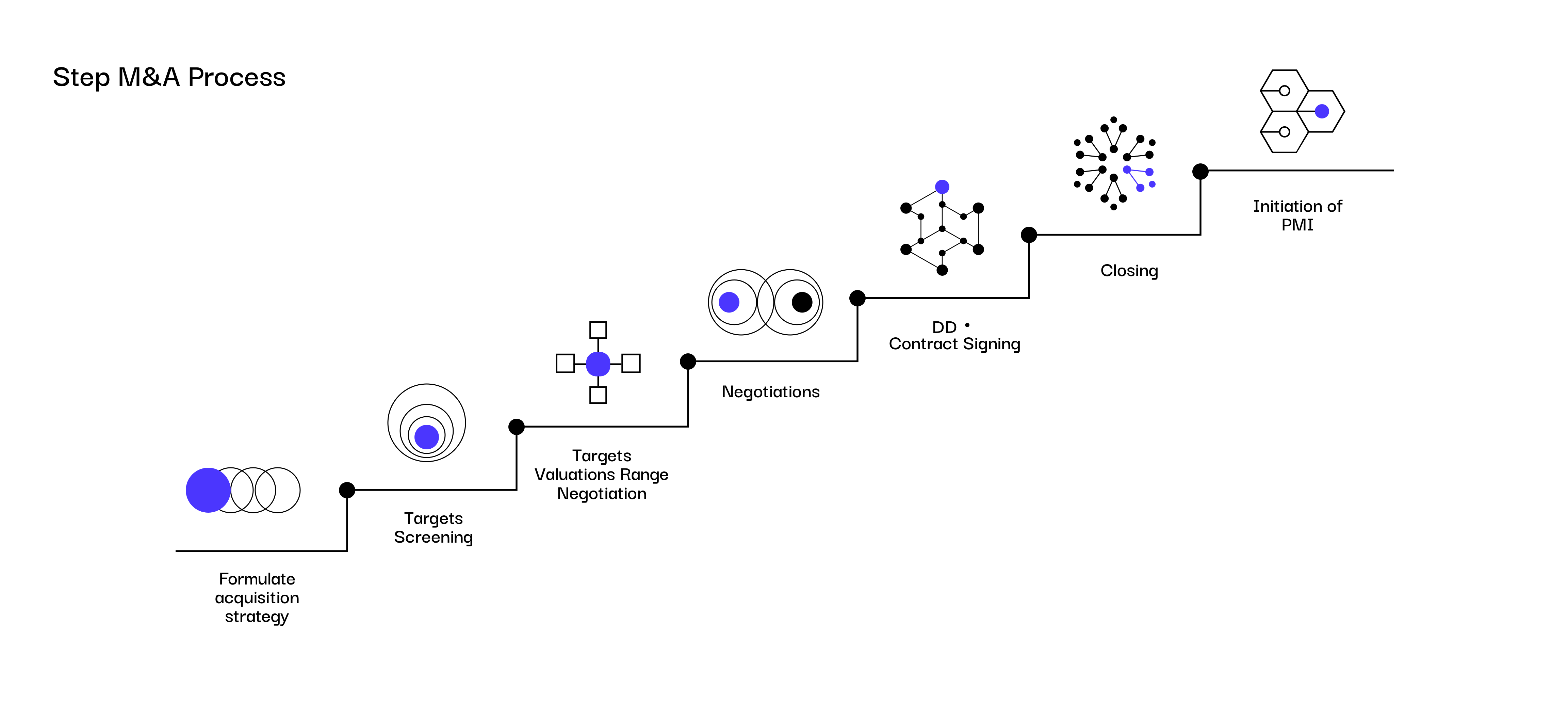

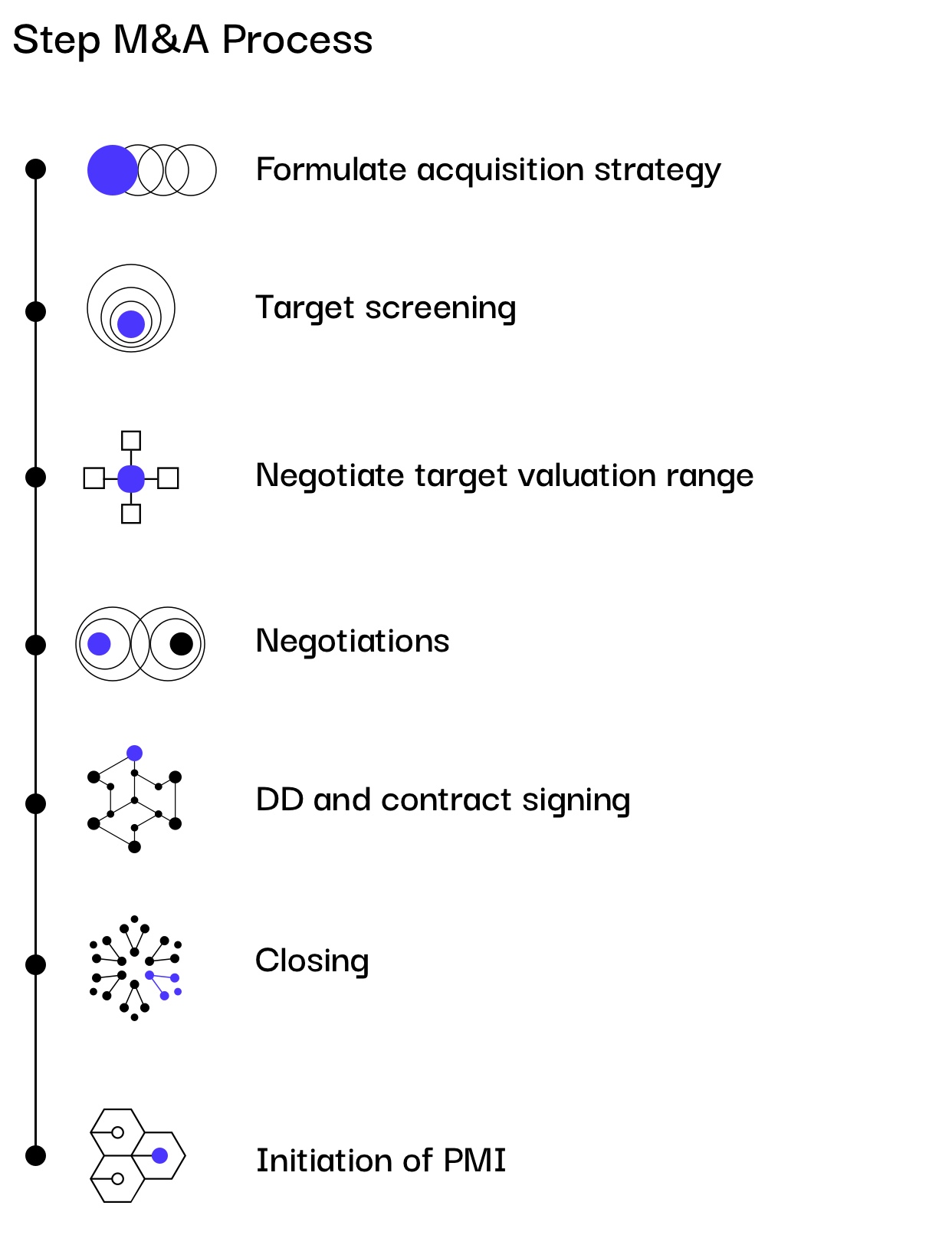

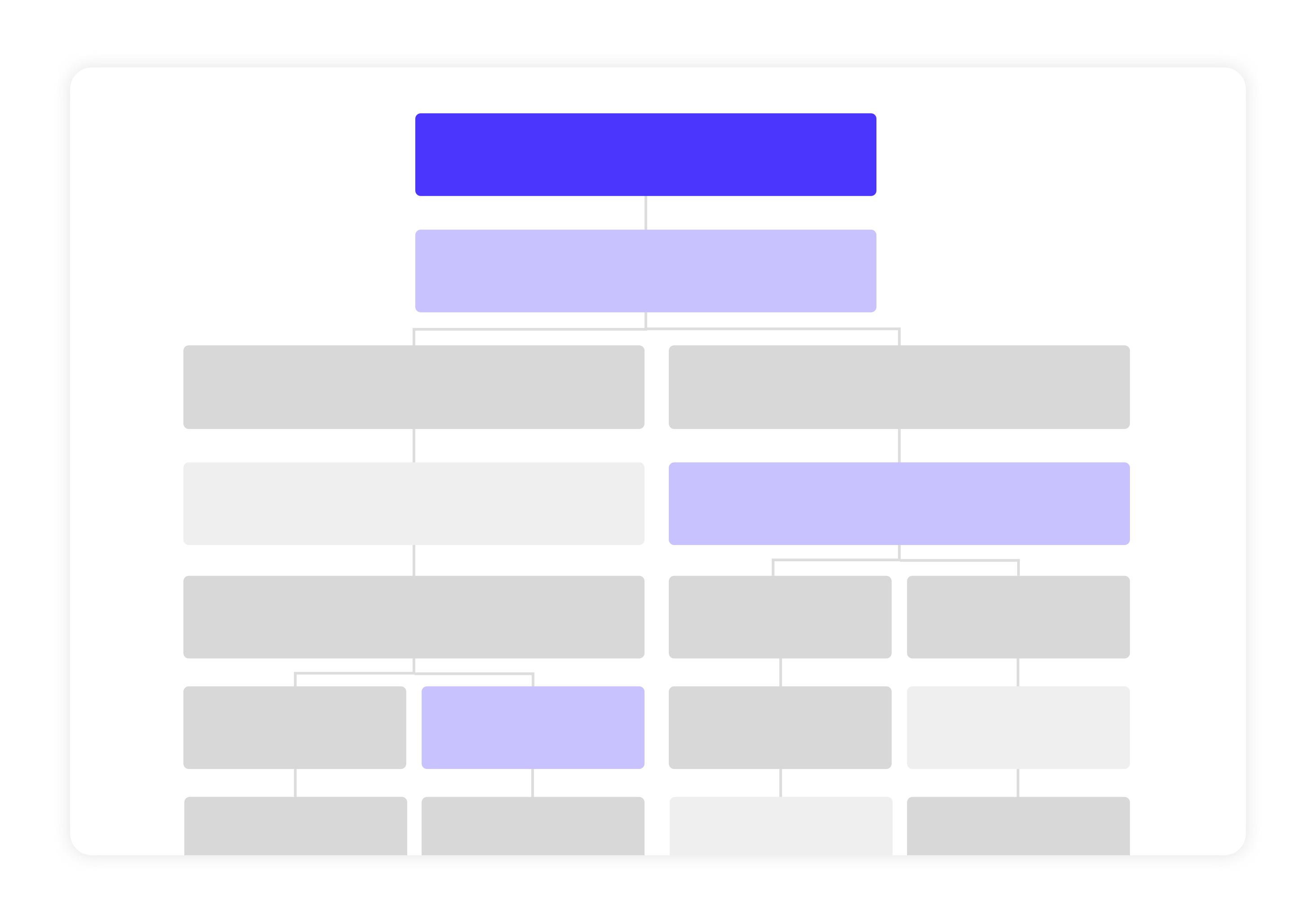

Phase 1

Approx. 1~2 months

Development of Acquisition Strategies

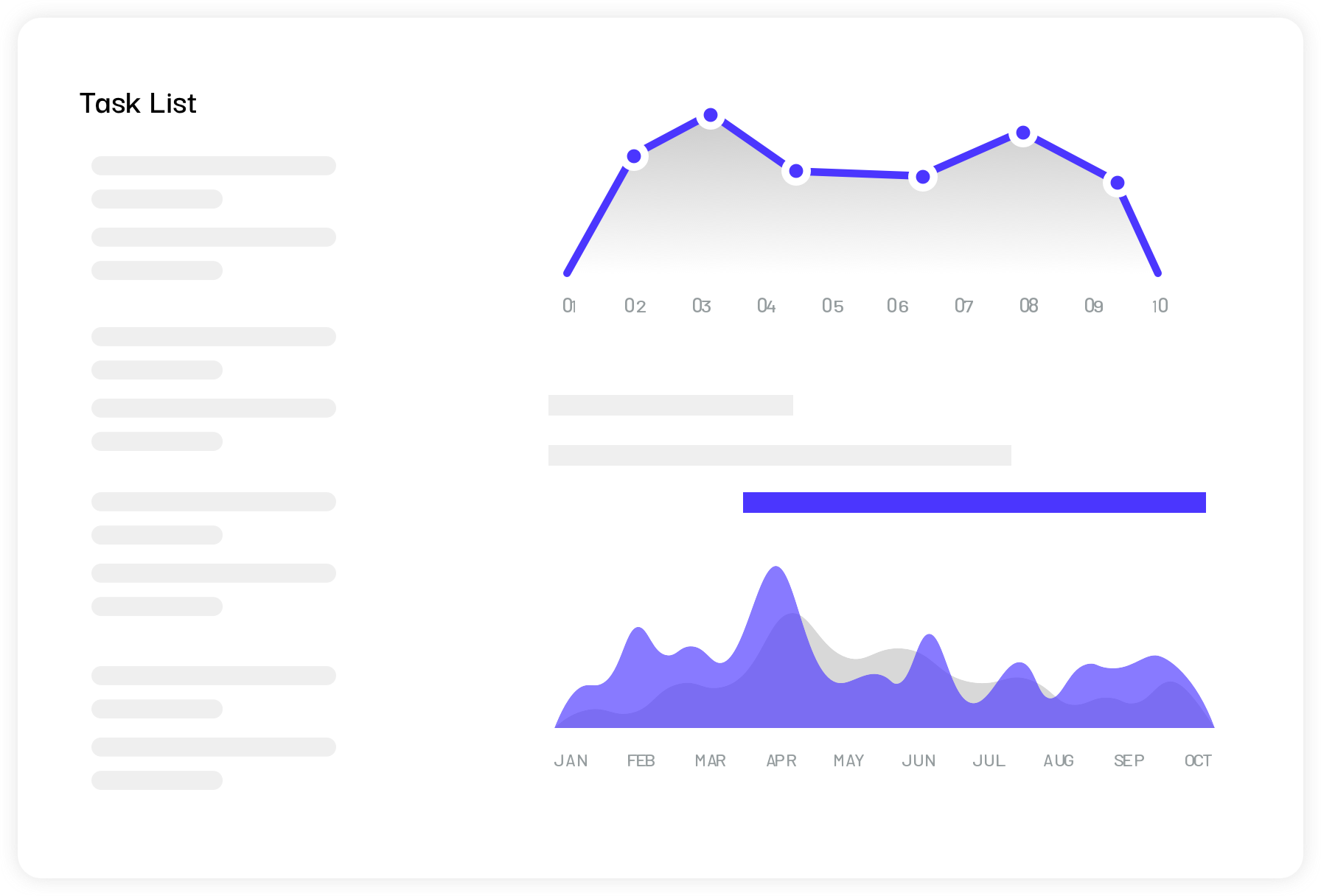

Tasks

- Define the acquisition's purpose and its potential benefits for both the acquiring company and the target company (e.g., enhancing scale through access to development resources, offering stable projects to the target company, etc.).

- Establish key criteria for identifying suitable acquisition targets (e.g., operating margin, sales growth rate, number of developers, geographic location, etc.).

Milestones

Defining clear M&A objectives.

Ensuring alignment with the overall company strategy.

Establishing acquisition criteria.

Structuring financing options.

Timeline

Completion of deliverables within 3-5 weeks.

Phase 2

Approx. 2 - 3 Months

Target Screening

Tasks

- Identify and assess potential target companies based on predefined acquisition criteria to compile a long list of acquisition candidates.

- Initiate contact with the identified companies.

- Conduct on-site visits to verify their interest in selling and to gather rough terms and conditions.

Milestones

Developing a screening strategy for acquisition targets.

Compiling a long list of candidate companies based on acquisition criteria.

Initiating contact and interviews with the identified targets.

Creating a short list based on the outcomes of the interviews and contacts.

Timeline

6 - 8 Weeks

Phase 3

Approx. 1 - 2 Months

Negotiation of Valuation Ranges

Tasks

- Upon establishing interest in an acquisition, execute a NDA to secure access to management and financial data

- Calculate the valuation range

- Check the range of valuations from the seller.

- Calculate valuations based on fundamental information and propose reasonable offers.

Milestone

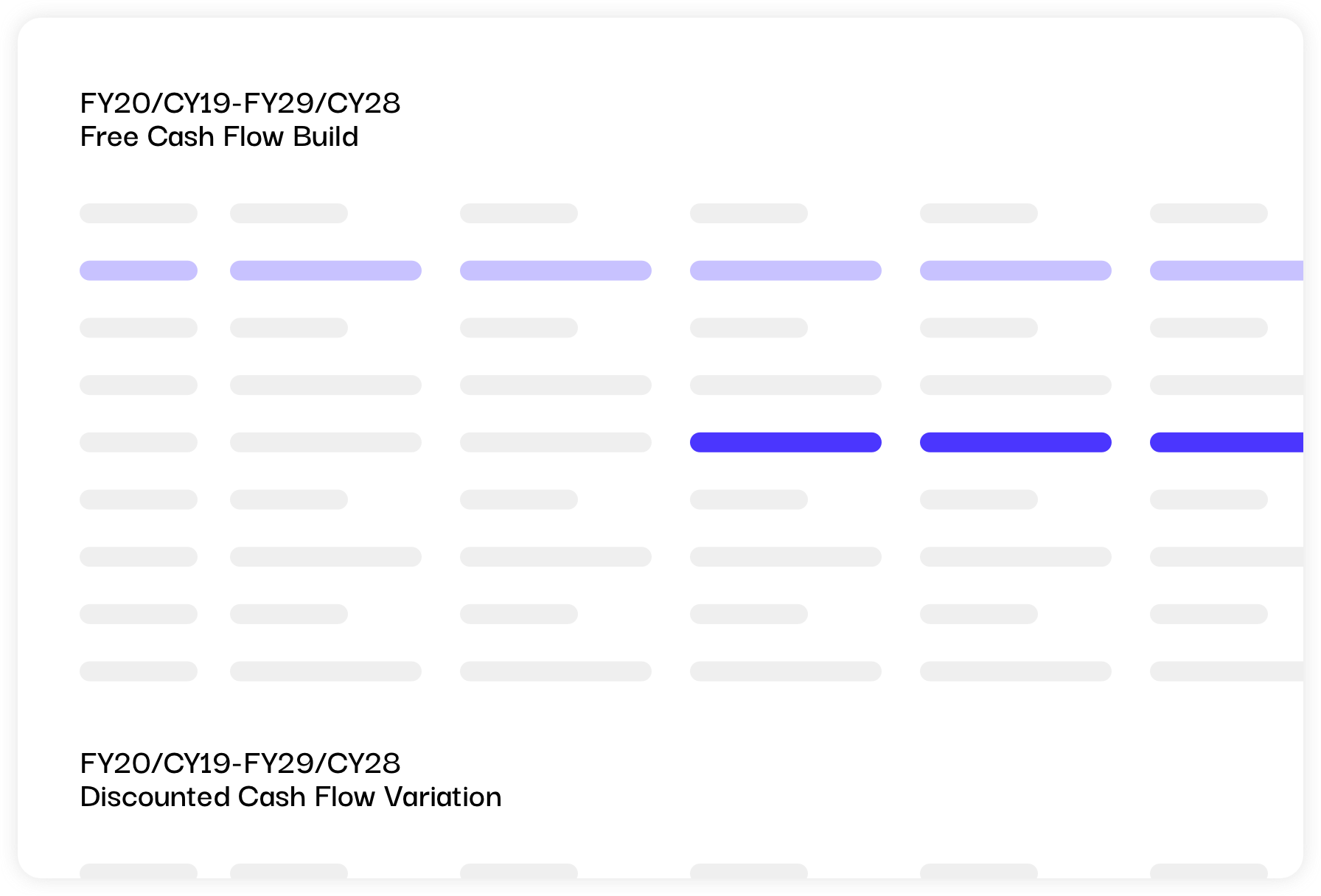

Analysis of benchmark companies

Compiling valuation data

Investment models including buyout ratios, earnout structures, etc.

Timeline

3-4 weeks

Phase 4

Approx. 1 - 2 months

Negotiations

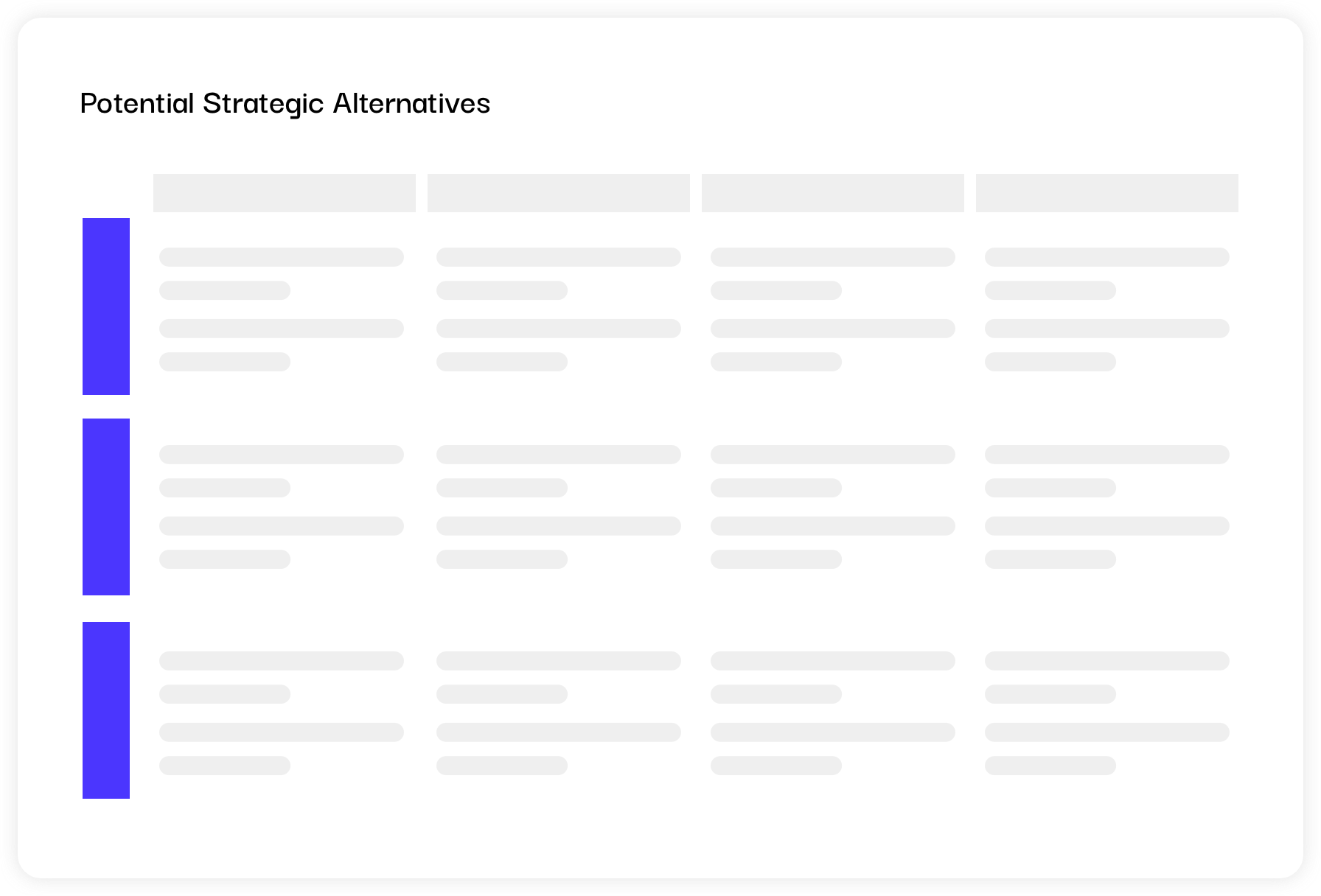

Tasks

- Defining the acquisition ratio, terms of purchase for any remaining interest (if not a 100% acquisition), and the vesting schedule.

- Non-competition agreements, post-acquisition employment terms for key personnel, SO grants and terms, earn-outs, etc.

- Determining the fundamental terms and conditions of the acquisition, with particular emphasis on 6.7.

- Establishing exclusive negotiation rights as an important matter excluding 6.7.

Milestones

Finalizing the investment model.

Signing of MOU/LOI

Timeline

2-3 weeks